- Import Employees (CSV)

- Import Employers (CSV)

- Import from FPS

- Import from Sage 50

- Import from Moneysoft

- Import Umbrella Amounts (CSV)

- Import Payment Amounts (CSV)

- Import Hours Worked from TimeMoto

- Import Hours Worked from uAttend

- Import hours worked from People Planner

- Import Pay Codes

- Import To Multiple Employers

Change amount paid on a Payrun

This guide is about how to make changes that affect a single payrun.

If you want to make changes that affect all future payruns, you should instead edit the default for the employee

The initial values on a payrun come from the defaults for the employee, but you can edit them on an individual payrun.

Any changes you make here will affect just this payrun.

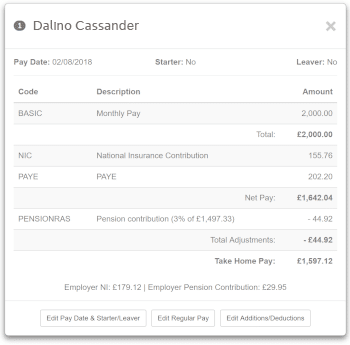

Editing a Payrun Entry

Select Payroll in the main menu. If you haven’t already started the payrun, then do so by following the on-screen instructions.

You’ll see a list of all employees included on the payrun. You can select any entry in the list to edit it.

Regular Pay

Selecting the first line will allow you to edit the basic pay amount. Alternatively, you can click Edit Regular Pay.

Additions and Deductions

Selecting an existing addition/deduction or the relevant button on the page will allow you to make changes, using any Pay Codes you’ve created

Auto-Calculated Lines

You cannot edit the tax, NI and other auto-calculated fields. Any lines related to pensions, student loans, etc are calculated based on the settings for the employee

Saving Changes

As you make changes, you’ll notice that the auto-calculated lines automatically update for you.

Once you set up the entry how you want it to be, you can close the window.