- Import Employees (CSV)

- Import Employers (CSV)

- Import from FPS

- Import from Sage 50

- Import from Moneysoft

- Import Umbrella Amounts (CSV)

- Import Payment Amounts (CSV)

- Import Hours Worked from TimeMoto

- Import Hours Worked from uAttend

- Import hours worked from People Planner

- Import Pay Codes

- Import To Multiple Employers

Import Pay Codes

If you have multiple Pay Codes, you can import them from a CSV file to save you manually creating them.

Start by going to the Pay Codes page. This can be accessed by clicking the employer name in the main menu and choosing Settings > Pay Codes, then selecting Import.

CSV Format

As a minimum, your CSV file must have a single column with the header value Code.

By default, the code will import as an addition code, using a fixed value subject to NI, Tax, Pensions and Attachment Orders.

Optional Columns

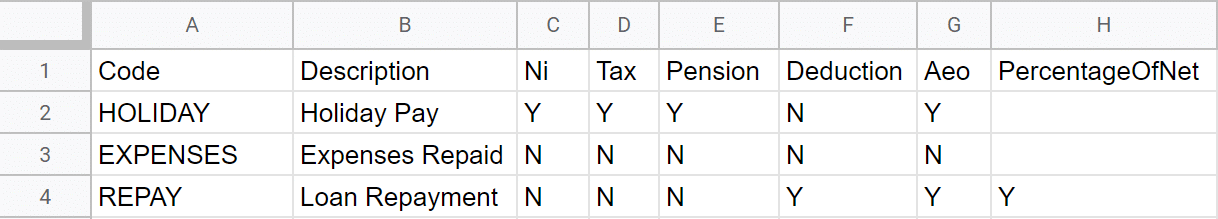

You can optionally include a column with the heading “Description” to provide a description for the code.

To override the default values for the above, the column names to use are:

- Tax

- Ni

- Pension

- Aeo

- Deduction

- Hourly

- Daily

- PercentageOfGross

- PercentageOfNet

- MultipleOfHourlyRate

These are all true/false columns.

To set the value to true, you can provide any of the following values:

- yes,

- y,

- 1,

- true

Any other value will be assumed to mean false.

You can also optionally include a column with the heading DefaultValue to set the default value for the pay code.

This should be a numeric value with no currency or percentage symbol.

If you’re importing codes with a Calculation Type of MultipleOfHourlyRate, you will want to include a column with the heading HourlyRateMultiplier to set the multiplier.

Import Preview

After submitting your CSV file, a preview of the codes that will import will display.

Follow the on-screen instructions to confirm the import, and your codes will be immediately imported and available for use.