A Guide to Calculating Annual Leave Pro-Rata

30th Nov '23

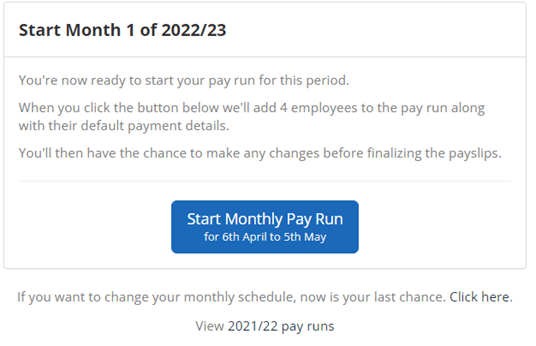

Many of you have already closed your tax year 2021/2022 and have moved into the tax year for 2022/2023. If you are still to do this, here’s a preview of what to expect.

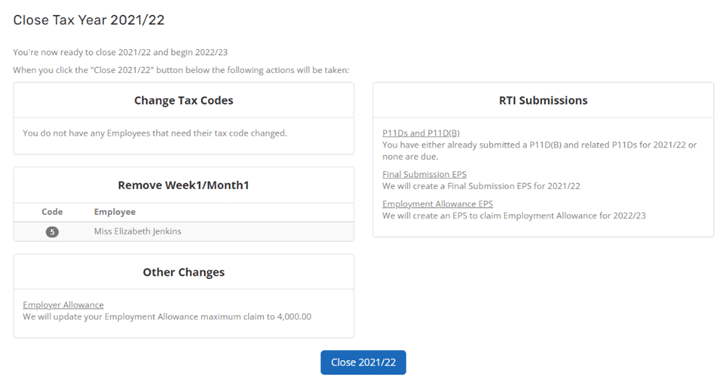

Unlike other years, there isn’t a change to the personal allowance from 2021-2022 and 2022-2023, so there are no automatic changes to Tax Codes.

If you have any Coding Notices for the new year, they’ll be auto-applied as soon as you start your first payrun.

Any employees with the Week1/Month1 flag set will have it automatically removed. The employees this applies to, if any, are listed.

If you’ve entered email addresses for your employees, you can automatically email P60s to them.

If P11Ds or a P11D(b) is due, we will inform you and create them for you.

We will also create your EPS to confirm you have finished your year if you have not already sent this.

If you claimed Employment Allowance in 2021/2022, to enable you to claim this again for the 2022/2023 tax year, we then create an EPS to send to HMRC.

If you claimed the maximum Employment Allowance of £4,000, we update your settings automatically to use the new maximum of £5,000.

Finally, any employees on the national minimum wage will be automatically updated.

Anna Stephens, March 31st, 202230th Nov '23

26th Sep '23