Plug our payroll into QuickBooks

In a couple of clicks, you can learn how to integrate Staffology Payroll Software with QuickBooks.

Getting started

You’ll require a QuickBooks account to get started. If you don’t have one yet, explore their plans and set up your accounting software.

Create a Staffology account, which is free up until you want to submit a real FPS to HMRC.

Get started with these basic steps:

- When you’re ready to connect your payroll software with QuickBooks, you will need an employer in Staffology.

- You can do this by either following our on-screen prompts or creating one in a demo.

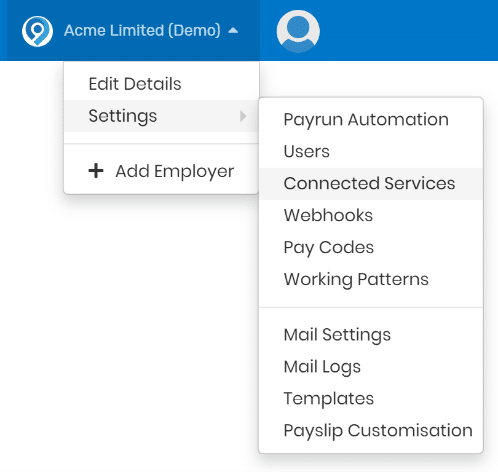

- Select an employer name within the main menu.

- Go to Settings > Connected Services.

Then click on the employer name in the main menu and go to Settings -> Connected Services.

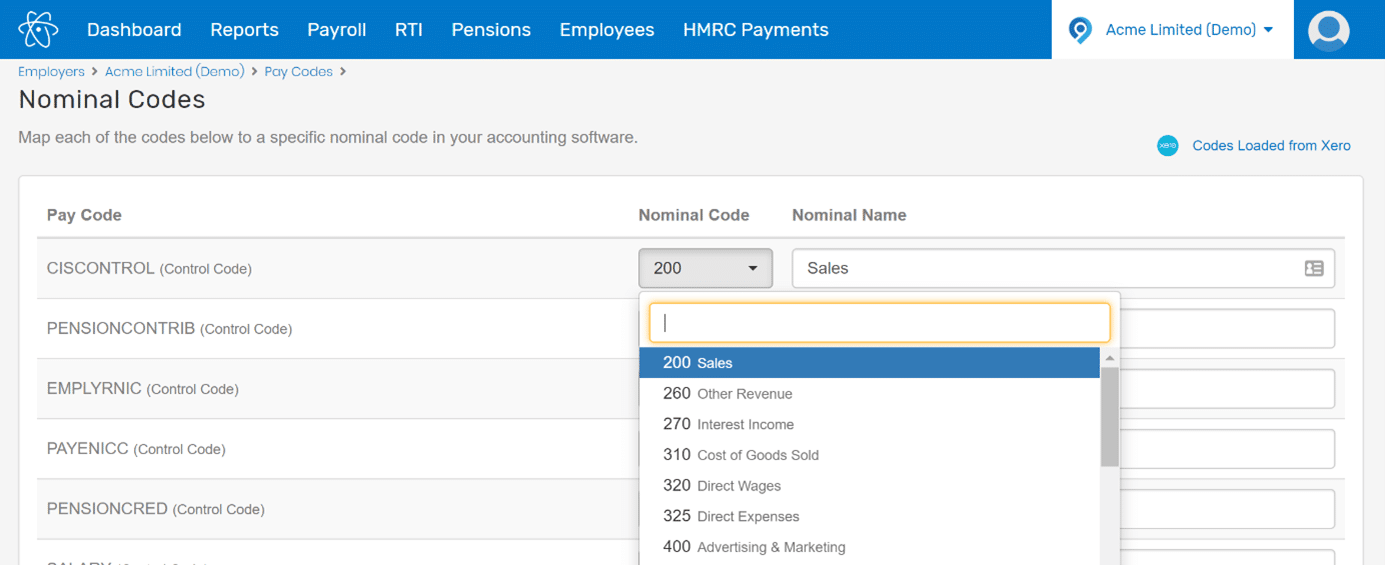

You can use the “Accounting” tab and select the QuickBooks icon.