A quick guide to calculating labour turnover

28th Feb '24

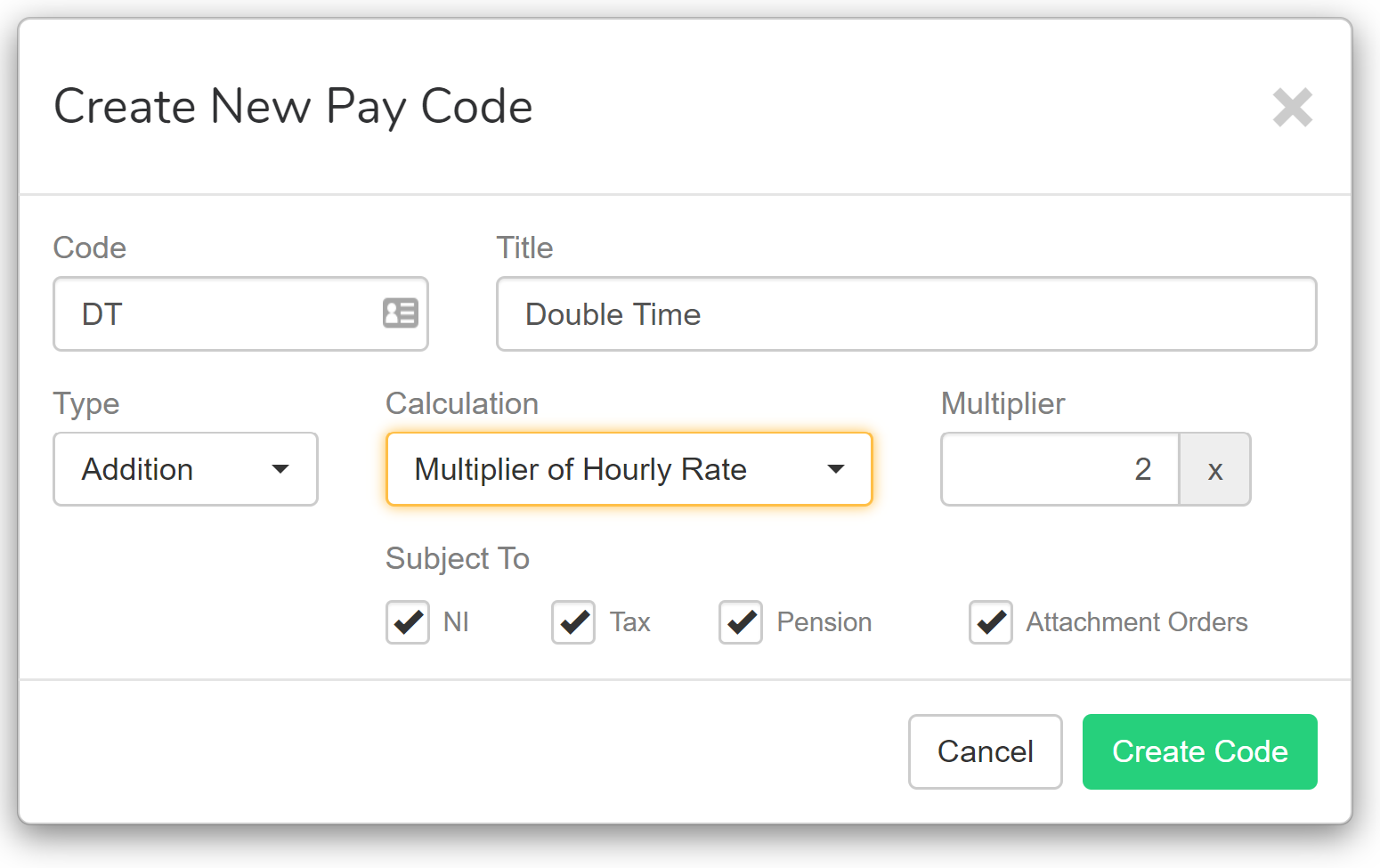

We’ve just added support for a new type of pay code.

Many of you either import hours worked from an external system or CSV file. Or you pay your employees on a salary rather than an annual rate.

For the former, adding overtime and double time is easily done. But for those managing salaried employees it’s a bit more fiddly.

So we’ve added the ability to set up a pay code as a multiplier of the employees base hourly rate.

This is distinct from the already existing option to pay an hourly or daily amount as rather than letting you enter the hourly rate, you instead enter the multiplier you want is to apply to the employees’ base hourly rate.

As with many of the features in our payroll software, we try to keep it hidden until you require it. So the ability to set a base hourly rate for an employee isn’t shown until you create a pay code that needs it.

For more information on how to use this new feature please refer to the relevant page of the User Guide.

Duane Jackson, July 25th, 202028th Feb '24

2nd May '23