A quick guide to calculating labour turnover

28th Feb '24

One of the benefits of working with an experienced team like our new colleagues at IRIS is that they can pre-empt a lot of issues that they suspect will likely come up in the future.

We’re now adding some areas of functionality to address some of them.

First up is the overriding of calculated values.

You can now override the individual YTD calculations used as a starting point for an open payrun.

As it says in the User Guide, please be very sure you know what you’re doing if you use this facility

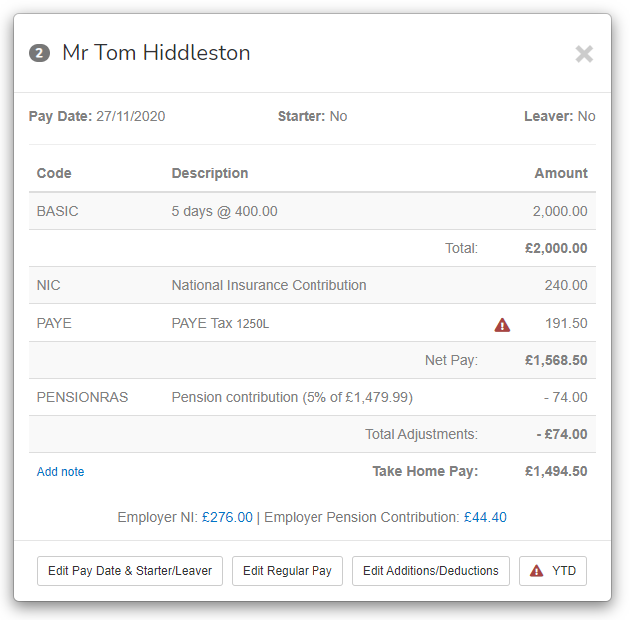

This is likely more commonly used. You can click on any auto-calculated value (PAYE, NI, Pensions) etc and override the value.

The most common reason for this is getting the calculation to match an external system where they may be off by a penny.

Whenever you override a value this will be clearly highlighted with a red exclamation mark so you know it’s been overridden.

We also provide a text field and strongly encourage you to enter a reason for the override to remind your colleagues or future self why the change was made.

You might not need this functionality right now, but you’ll be glad it’s there when you inevitably do in the future.

Look out for plenty more small improvements like this over the coming weeks.

Duane Jackson, January 19th, 202128th Feb '24

2nd May '23