Complete, cloud-based HR & Payroll solutions

Whether you need to run payroll for 50 employees or 5000, Staffology payroll software makes it easy.

Staffology is for all UK businesses, from start-ups to large businesses. Whether you want an automated solution that takes the manual processing out of payroll for your small business, a payroll software you can white label as an accountant, or payroll powered by an API so you can fully integrate it with your HR, employee or other systems. We power payroll for your business, and hundreds of others across the UK.

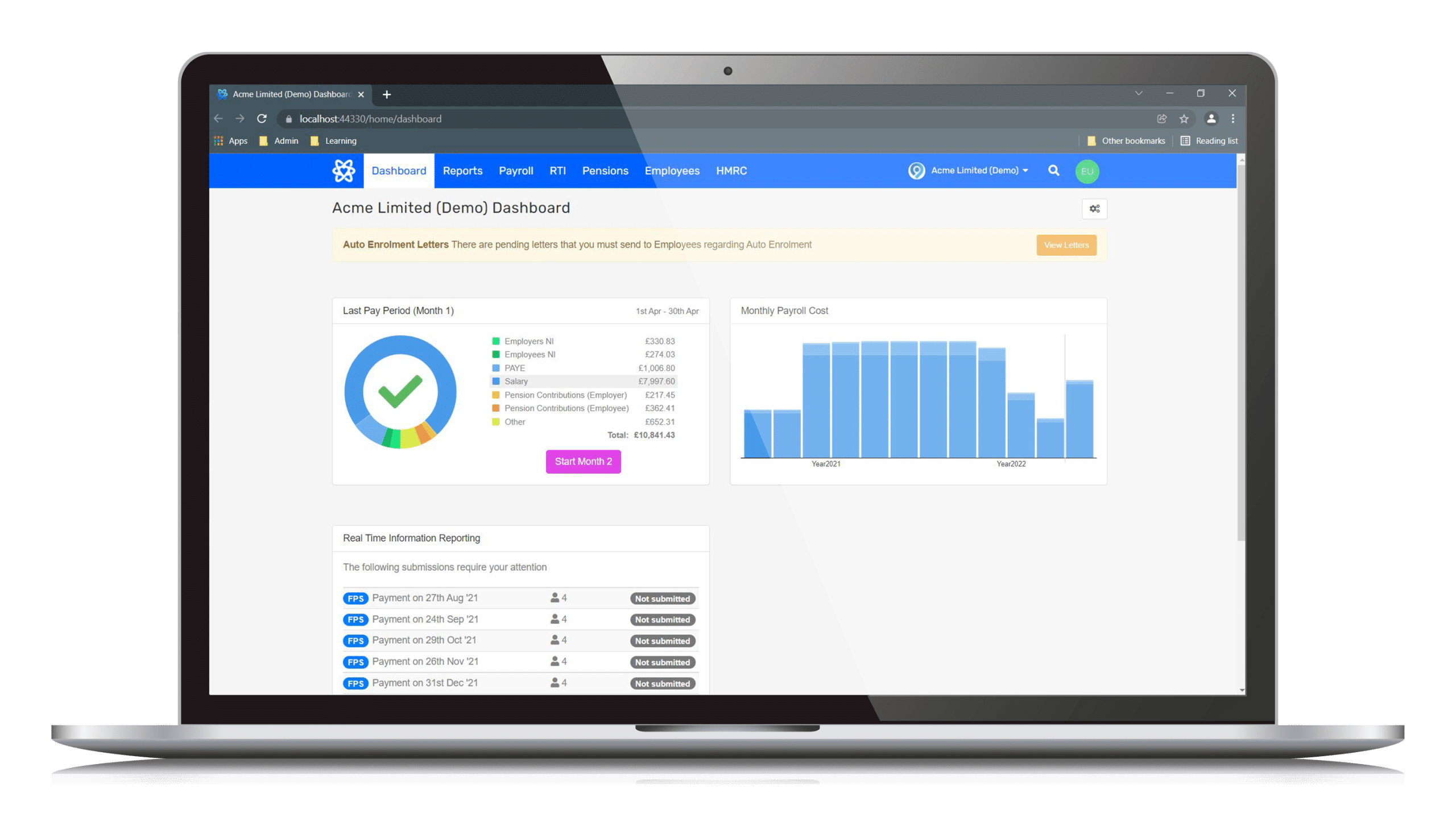

Modern, intuitive interface

Integrate with any third-party software

Automate Tasks

HMRC Recognised (RTI & CIS)

Start your free trial

Start your free trialPricing

Only pay for the payslips you use.

Pricing is based on the number of payslips created each month.

The cost per additional payslip reduces as you add more employees, making this a cost efficient solution for large or small businesses.

Staffology Payroll starts at £39 per month, plus:

1 to 19

Payslips

INCLUDED

20-50

Payslips

£1.95 per payslip

51-10K+

Payslips

POA

Calculator

Enter a number of payslips to calculate the monthly cost.

Minimum monthly charge of £39.

The cost per additional payslip reduces as you add more.

All prices are subject to VAT.

Features

Just because it’s easy-to-use, doesn’t mean it’s basic. We’ve included all of the features you would expect to find in a mature payroll product.

Payroll

Automation

Powerful,

Comprehensive API

Accounting

Integration

Umbrella

Companies

CIS

Supported

Off-Payroll

Workers

Coding

Notices

Minimum

Wage

All this automation, ready to go out-of-the-box.

Start your Free Trial Today

Start your Free Trial TodayPrior to using Staffology our payroll processing took 3 weeks and required 3 staff members on average. With the use of Staffology, we have one staff member working intermittently on payroll over 3 days.

Jamil Raja, jraja.co.uk