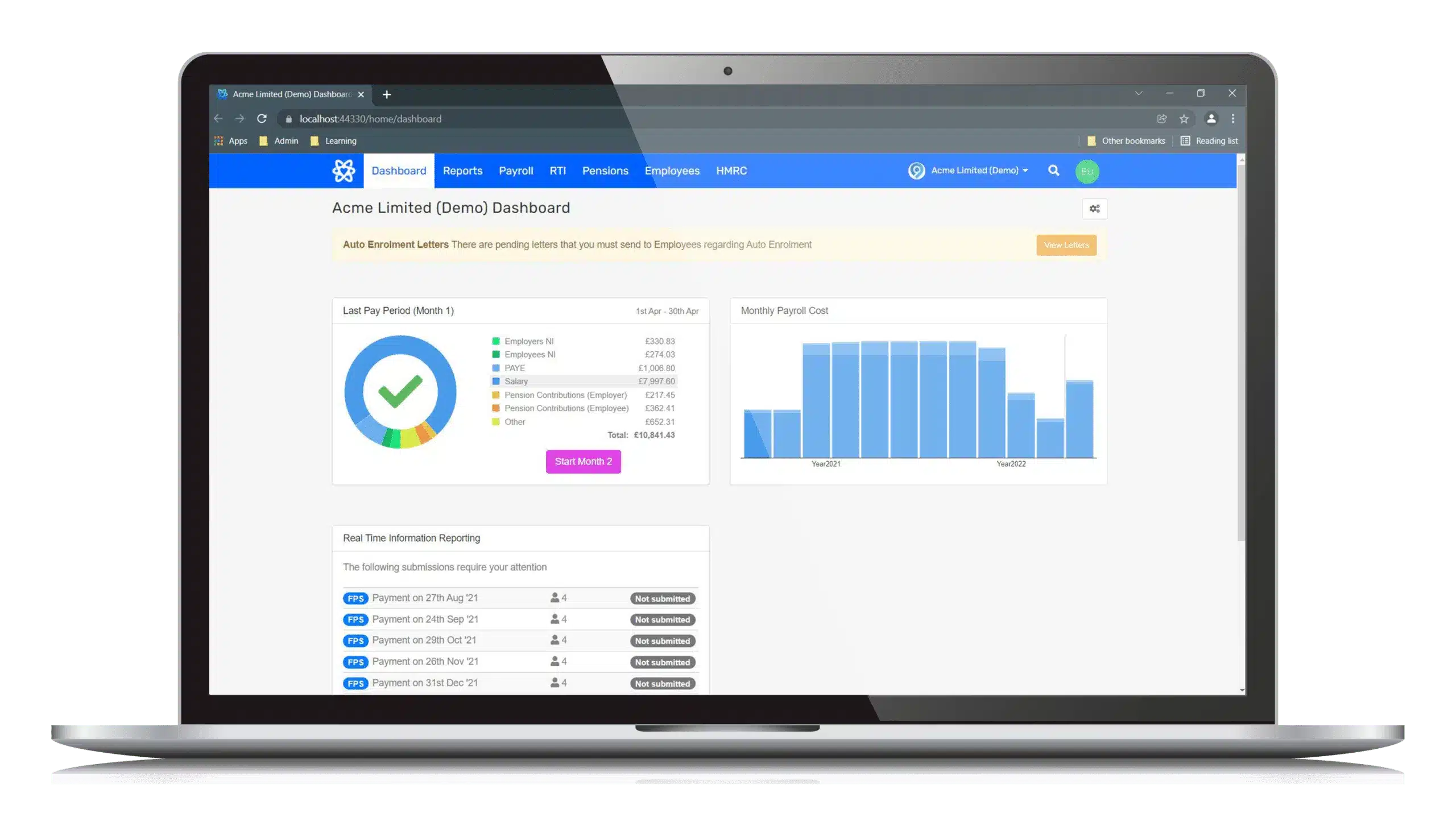

Control Costs

Staffology only charges based on the number of payslips created every month. This cost reduces every time more employees are added into a pay run, making Staffology both cost-effective and scalable.

No matter how many payroll clients you manage, you can have greater control over costs by running all payroll under one account. This means that you get the best discount, because we only charge you for the total number of payslips