Payroll for CIS

Full support for managing and paying Subcontractors under the Construction Industry Scheme (CIS) regime.

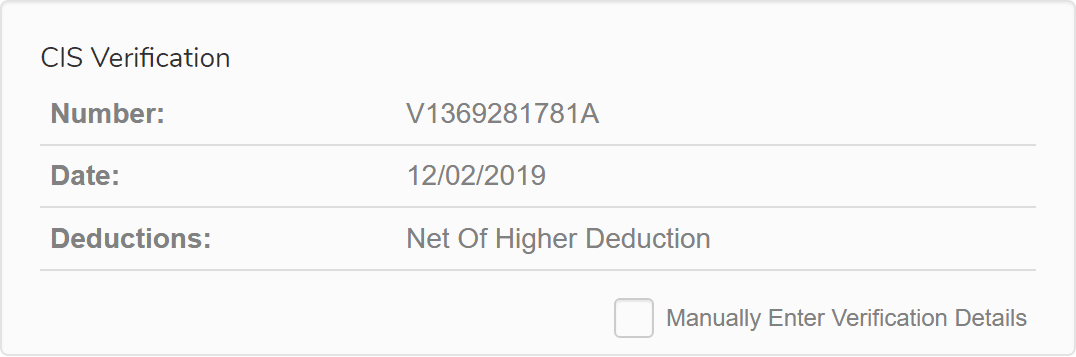

Our Cloud Payroll Software supports the whole journey of managing and paying CIS Subcontractors. From verification to monthly statements and everything in between, we’ve got you covered.