If an employee is on a salary sacrifice scheme and receives SMP, they do not have any pension deducted.

The employer’s deduction covers the amount you usually take from the employee.

So before SMP started, the employee’s pension deduction was 5%, with an employer’s deduction of 3%. Therefore, whilst on SMP, the whole 8% would be the employer’s pension amount.

Note: pensionable earnings are the usual earnings before SMP.

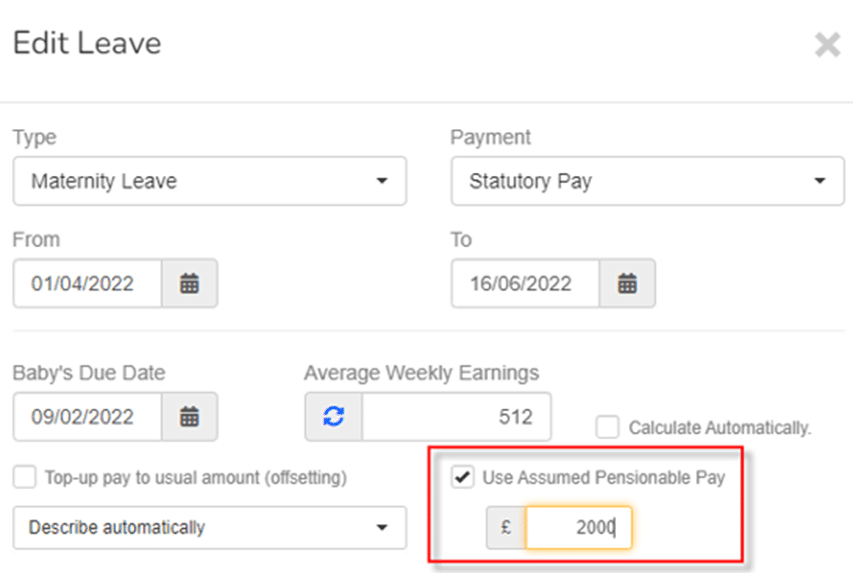

- Go to Employees, select the individual and then the Leave tab.

- Select + Add Leave.

- From the Type list, select Maternity Leave and set Payment to Statutory Pay.

- Enter the Leave From and To dates, then Baby’s Due Date.

- Select Use Assumed Pensionable Pay and enter the required value – the amount pension is deducted from before SMP begins.

- Select Update.

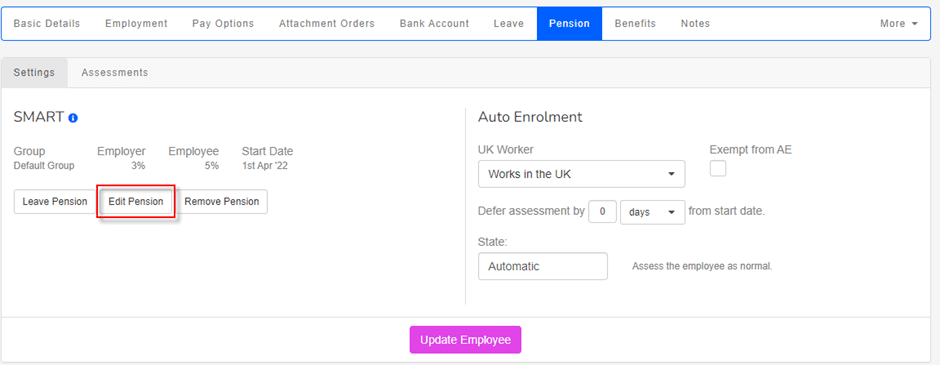

- Select the Pension sub-menu, then Edit Pension.

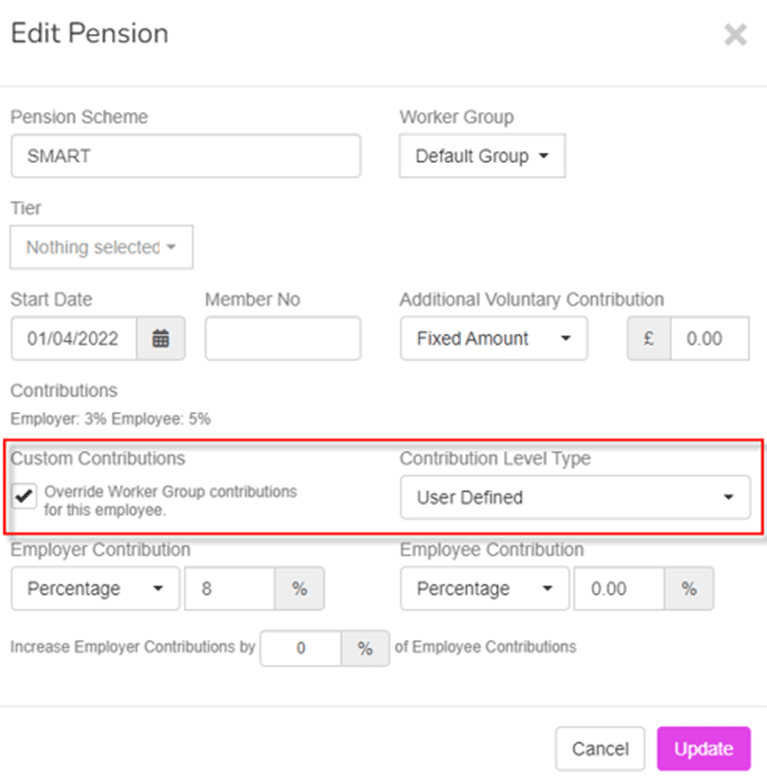

- Select Custom Contributions, then set the Contribution Level Type to User Defined.

- Change the Employer Contribution, setting the total to the usual employee and employer combined contributions. For instance, if these are usually 5% employee and 3% employer, enter 8% in Employer Contribution.

- Set Employee Contribution to 0.00% and select Update.

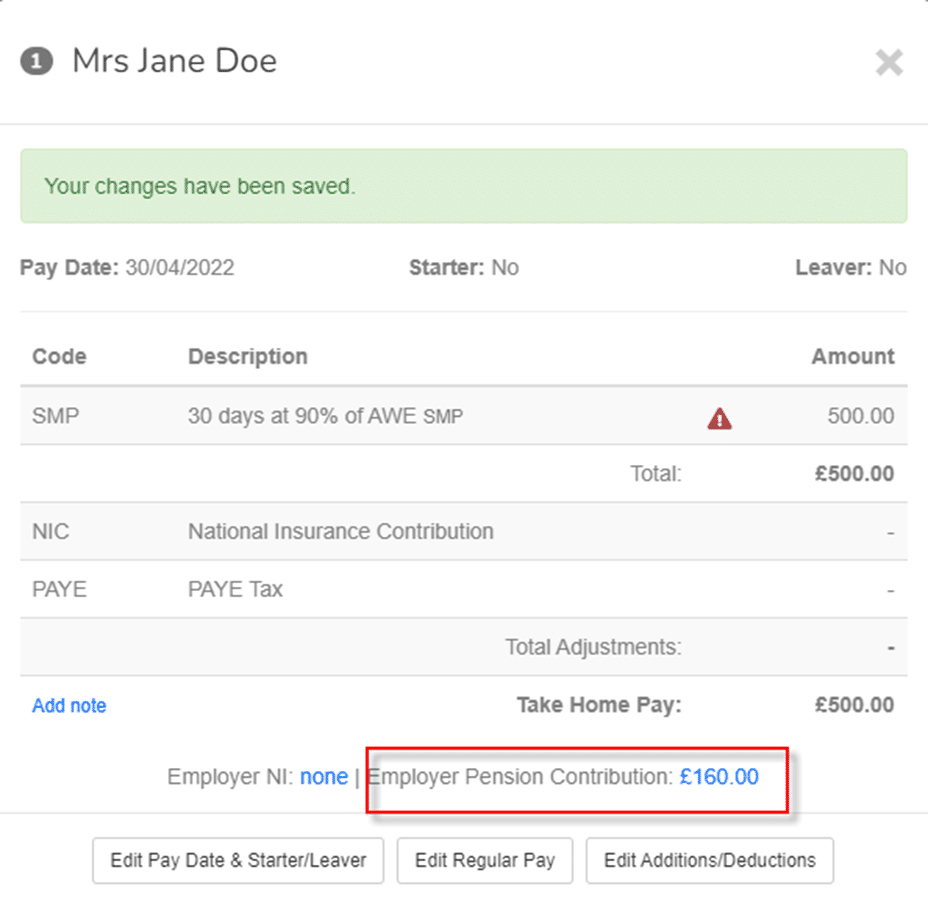

- From Payroll, process your pay run.

In this example, the Employer’s Pension Contribution is £160.00 (2000 * 8 %). We set the Assumed Pensionable Pay to £2,000.

Related Articles

Absence management: what is the Bradford Factor?

4th Jul '24