A Guide to Calculating Annual Leave Pro-Rata

30th Nov '23

Hi,

As we end the 2021/2022 tax year and begin the next one, here is some information on additional features recently added to the software.

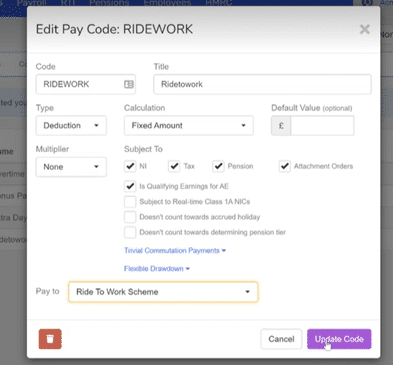

Under Settings > Pay Codes, when creating or editing a deduction, our recent release introduces a new To Pay field that enables you to set who to pay whenever you take the deduction.

Please note: this field will only be visible if you have Payees configured (also accessed from the Settings menu). The To Pay field by default sets to None, but you can select one of your previously created Payees.

When previewing/printing Reports > Payruns > Required Payments, this now includes any deductions with Pay to set.

We have added two new options to the Settings > Payrun Automation > Auto Submit Payments section.

These are the options available to select for Include Payments To:

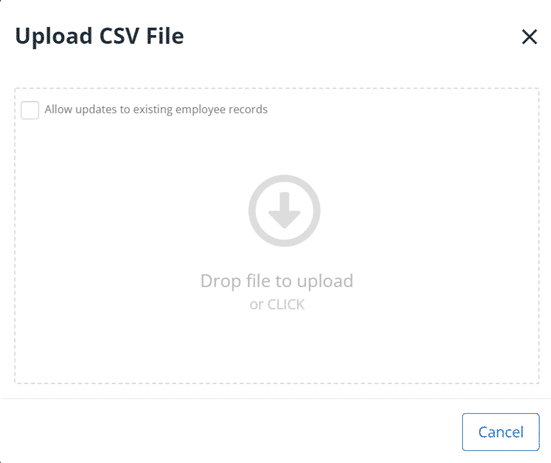

We have added the facility to update existing employees by importing from a CSV; previously, you could only import new employee records.

To import data to both new and existing employee records, from Employees > Import > Employees > CSV file, select Allow updates to existing employee records.

Please Note: Staffology will ignore columns on a spreadsheet if the fields are not updateable via import. See help

The SMP calculation now uses the correct thresholds when calculating the first day of the qualifying week. An issue was previously only occurring when the qualifying week spanned two tax years.

The Audit now includes any KIT days taken in Leave.

If you have any ideas for enhancements, please let us know directly via the Staffology Ideas Portal.

Please visit, create new ideas, and vote on ideas others have raised. We will give you feedback and tell you how our roadmap incorporates them.

Anna Stephens, March 17th, 202230th Nov '23

26th Sep '23