A Guide to Calculating Annual Leave Pro-Rata

30th Nov '23

Here we are, fast approaching Tax Year-end for Payroll! Can you believe it, another Tax Year is nearly over? We are busy working on the legislative changes for you, and these will be published in due course.

The latest Staffology release includes a new time-saving feature, detailed below.

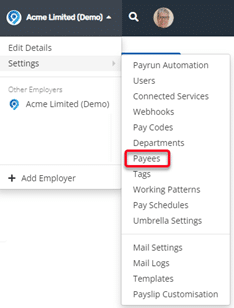

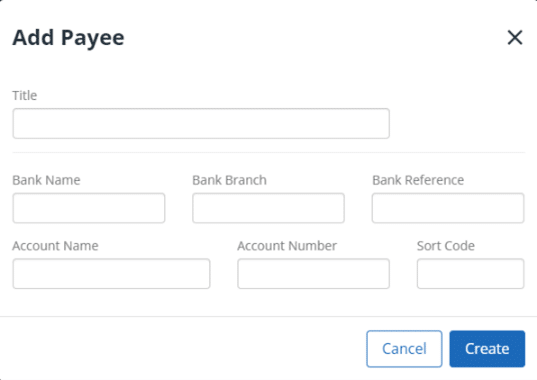

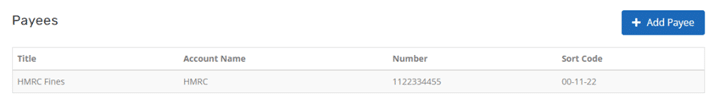

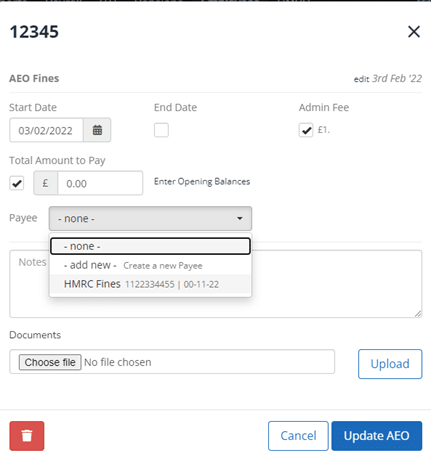

Under Settings, there is now a menu item, Payees. From this section, you can add/edit bank accounts you use for remitting payments for deductions, such as AEOs. Once created, rather than adding bank details against an AEO, you can now select the relevant Payee, saving time entering duplicate information time and time again, for instance, if you have multiple Council Tax AEOs with the same payee details.

The new Payee will appear on the screen – from here you can double click on it to edit if required.

* You can also select add new from the dropdown, enabling you to create a new Payee without having to go into Settings | Payees

If you have any ideas for enhancements like the one above please let us know directly via the Staffology Ideas Portal.

Please pay a visit, create new ideas and vote on ideas others have raised. We will give you feedback and let you know how they are incorporated into our roadmap.

Anna Stephens, February 9th, 202230th Nov '23

26th Sep '23