A quick guide to calculating labour turnover

28th Feb '24

Like most other payroll applications, we don’t include the Employment Allowance shown on the payrun journal. There’s good reason for this as in many potential configurations it simply shouldn’t be. A payroll developer will argue this point until he is blue in the face.

But in reality, for most employers where there’s just a single payrun every month then there’s no reason not to include it.

So we’ve now added an option to include the Employment Allowance amount (if any) on the monthly payroll journal.

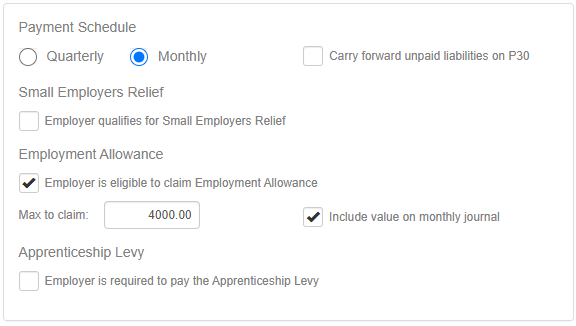

Edit the details for the employer, switch to the HMRC sub tab, and tick the relevant box next to the Employment Allowance settings.

For monthly reporting, the Employment Allowance amount will be shown on the journal once you close the payrun.

The same applies for quarterly reporting, but it’ll only show on the final month of the quarter.

We’ve also made a small change to make it easier for you to verify your Employment Allowance claims.

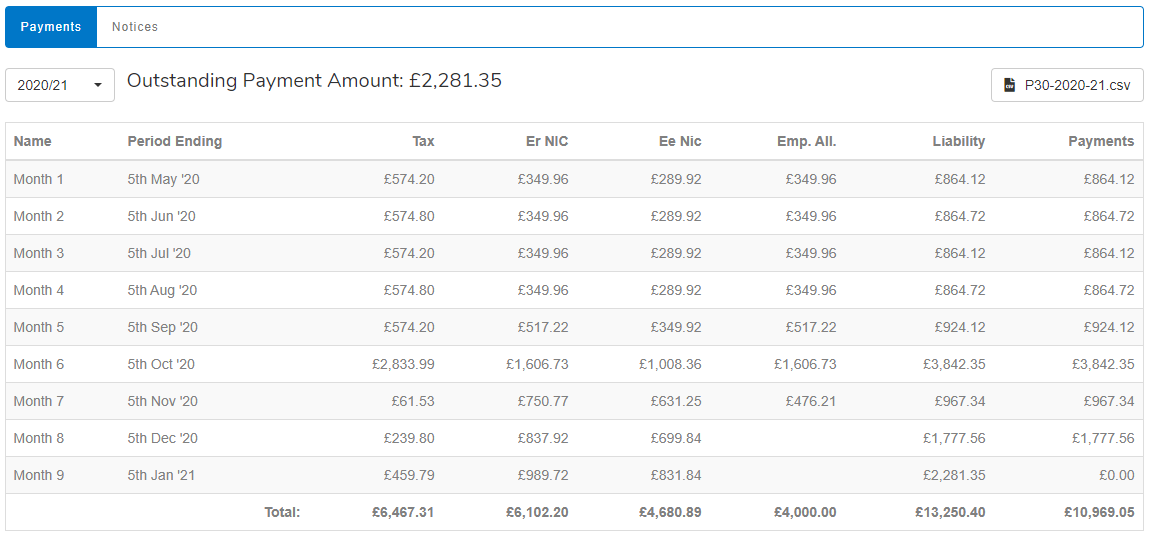

Under the main HMRC tab where you can access your liabilities, there is now a column to show the amount of EA that’s been claimed

This makes it a lot easier to see, at-a-glance, how much has been claimed and to verify that everything is in order.

28th Feb '24

2nd May '23