Payroll Software for Small Businesses

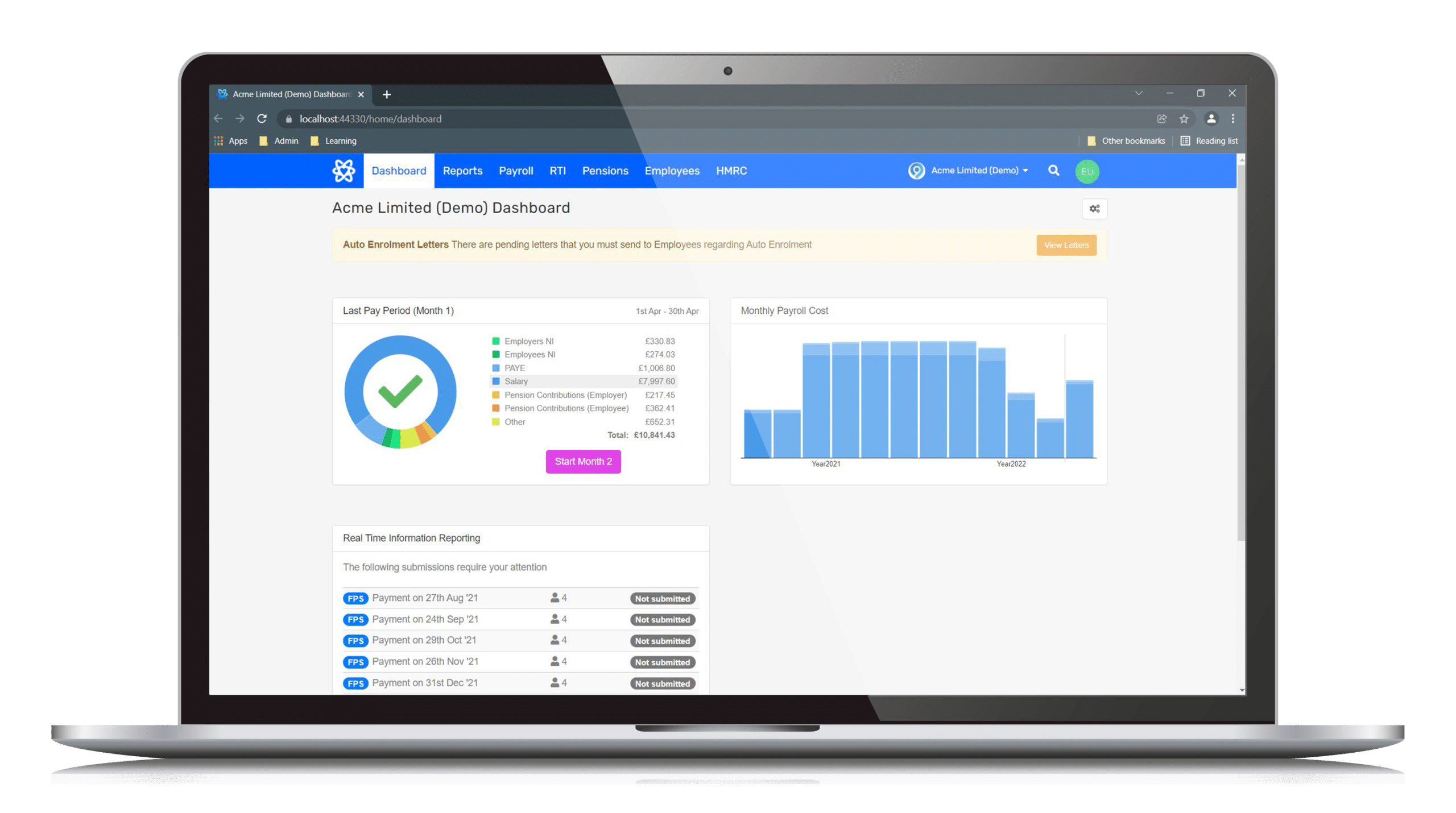

Unlike old-world payroll, Staffology is simple to scale, easy to use, and designed for self-starters. Manage pay, tax, expenses and more all in one place. When it’s this intuitive, you don’t have to be an expert to master payroll.

Don’t believe us? You can even practice your payroll at your own pace with our unlimited free trial.

Try our payroll software for free