Payroll for Off-Payroll Workers

Our software fully supports paying workers under the new IR35 Off-Payroll rules.

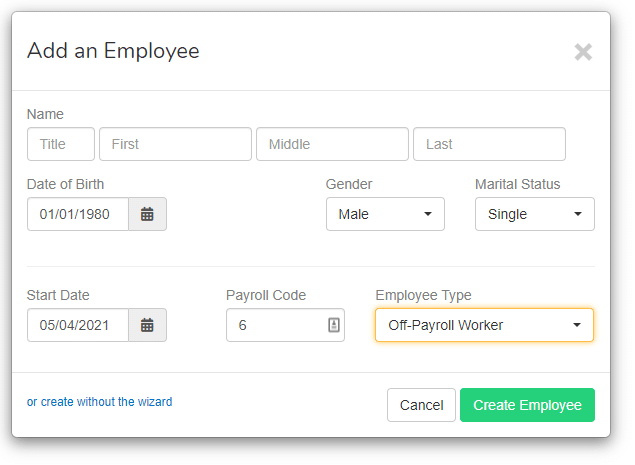

Our Cloud Payroll Software supports the whole journey of managing and paying Off-Payroll Workers. From creating the worker record, calculating the net payment and reporting to HMRC via RTI, we’ve got you covered.