- Import Employees (CSV)

- Import Employers (CSV)

- Import from FPS

- Import from Sage 50

- Import from Moneysoft

- Import Umbrella Amounts (CSV)

- Import Payment Amounts (CSV)

- Import Hours Worked from TimeMoto

- Import Hours Worked from uAttend

- Import hours worked from People Planner

- Import Pay Codes

- Import To Multiple Employers

Umbrella PAYE

Once you’ve set your Umbrella Settings you can now see the magic at work.

Start a pay run as usual.

Click on any of the employees in the list and click the icon at the bottom-left of the window.

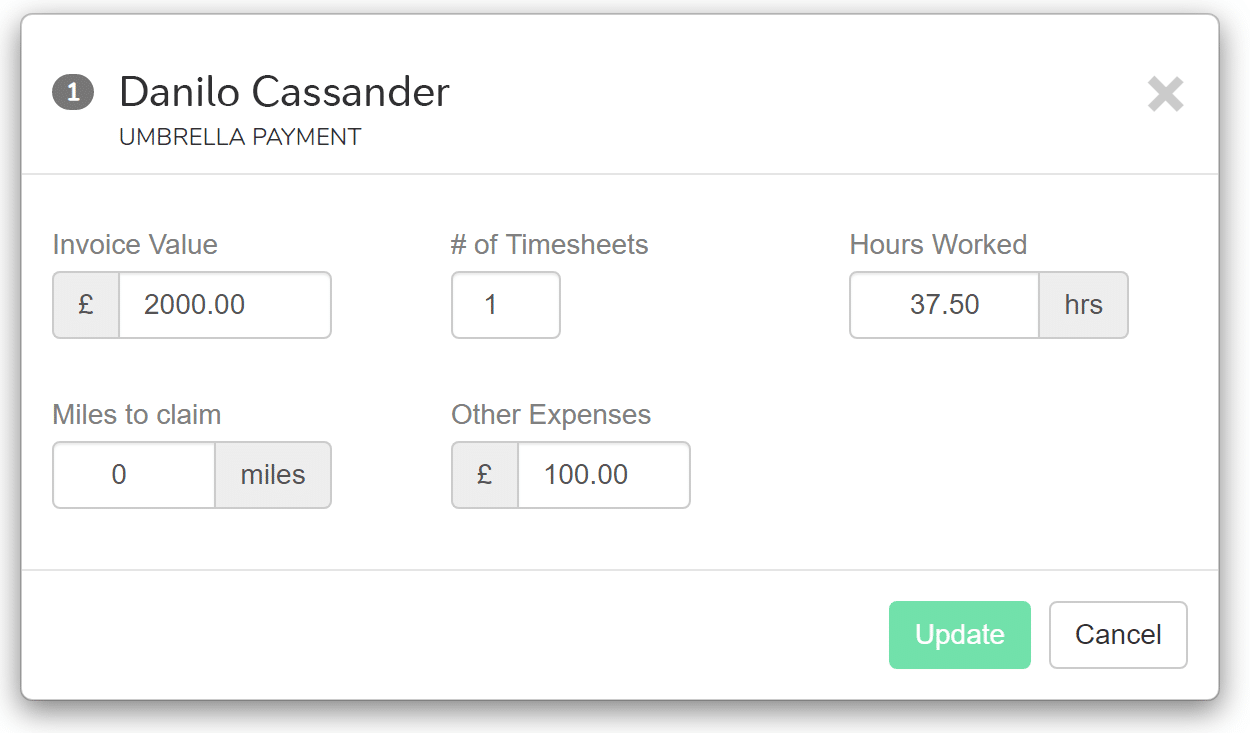

You now just fill in the form.

The “Miles to claim” only appears if you’ve assigned a vehicle to the employee.

If you want to override the charge per timesheet there is an option to do so

Click “Update”.

You’ll see that the payslip has now been updated. The appropriate amount has been paid at minimum wage, a payment for holiday has been added and the remainder as a Discretionary Profit Sharing Bonus.

If the employee has a pension then the contributions to that have also been taken in to account.

The take-home pay for the employee will be equal to the invoice value you entered, less any costs of employment (employers NI, employer pensions contributions, etc) and whatever fee you set to process the payment for them.

If you need to import multiple payments quickly then you can do so using the Umbrella CSV import option. Using this method also lets you specify the charge on a per payment basis.

Notes

- Any manual changes made to the entries on the payslip will mean the figures no longer add up to the invoice value.