Holiday Pay

Manage your legal requirement to provide leave to your ad-hoc workers.

Either paid instantly or accrued – all automatically tracked.

Manage your legal requirement to provide leave to your ad-hoc workers.

Either paid instantly or accrued – all automatically tracked.

We have the features you’d expect for managing holiday allowances and recording days off. But a lot of customers use our software to pay workers on an ad-hoc basis.

Rather than providing the statutory holiday entitlement in the form of days off work, they instead pay out holiday pay.

Sometimes it’s paid out as soon as it’s incurred, sometimes you want to track it and allow the employee to request payment from it when needed. Whatever your approach, we’ve got your covered.

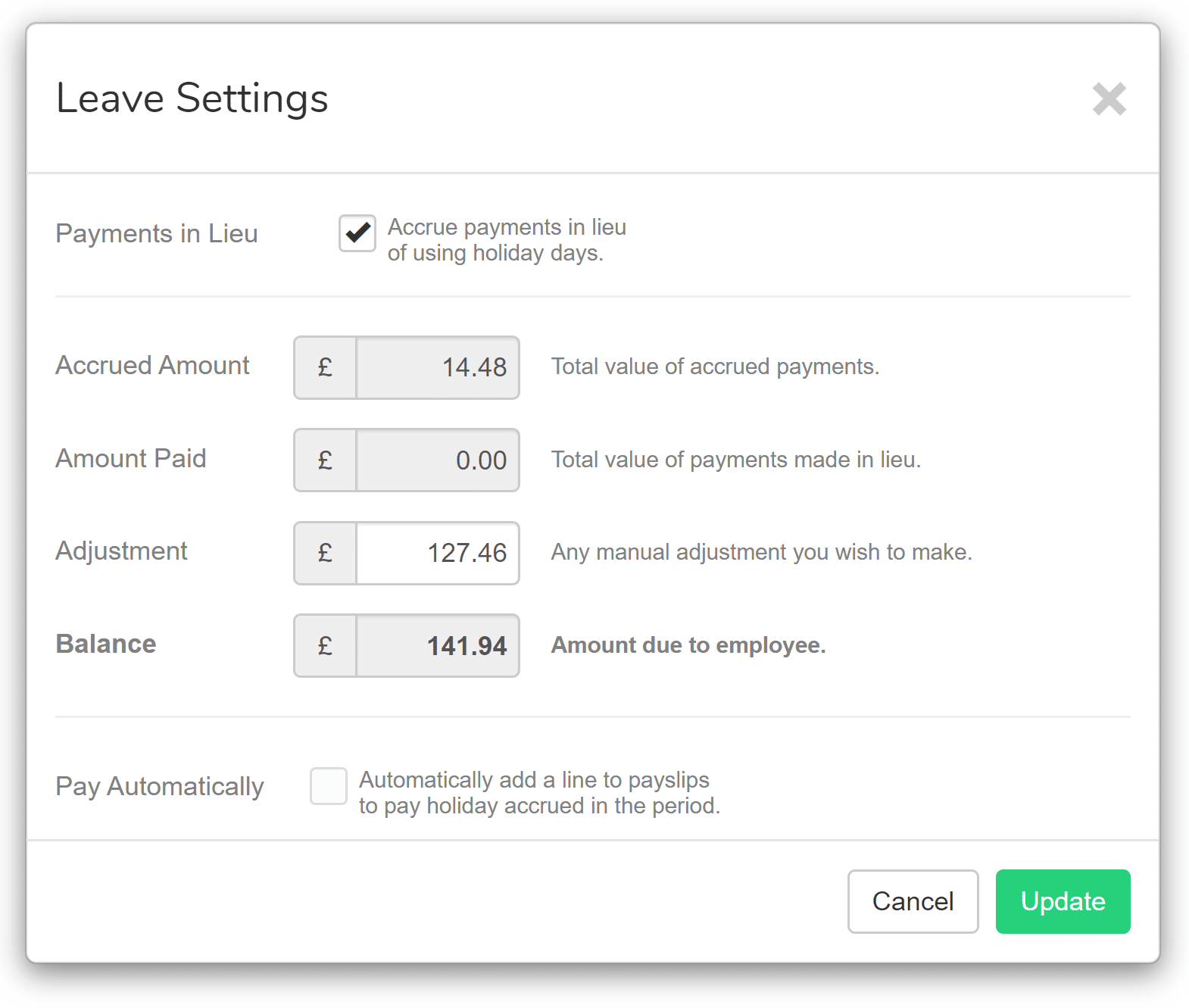

If you enable the “Payments in Lieu” feature then every time an employee is paid, we work out how much they should be paid to cover your obligations for statutory holiday.

The simplest solution is to enable the option to pay out the holiday as it’s earned. Enable this option and we’ll automatically add a line to the employees payslip to pay them their holiday pay.

The statutory holiday entitlement is 5.6 weeks per year. That’s 12.07% of the year if you worked full time.

So when you need to work out how much holiday an ad-hoc worker is entitled to you apply the same percentage to the time they’ve worked.

An employee who works 10 hours in a week would get 72.6 minutes of holiday pay.

12.07 ÷ 100 x 10 = 1.21 hrs

The result is 1.21 hours, which is 72.6 minutes. That means you owe the employee around 1 hour and 12 minutes holiday leave.

Alternatively you can let the amount owed to them build to be paid out at a later date. We’ll still calculate how much the employee is owed every time they’re paid, but we won’t automatically add any holiday pay.

Instead you can manually add a payment whenever you need to and the tracked balance is automatically reduced.

We also support manual adjustments to the liability.

And for a complete picture of your accrued holiday liabilities we have a report detailing all of the numbers – available as a PDF or a CSV file.